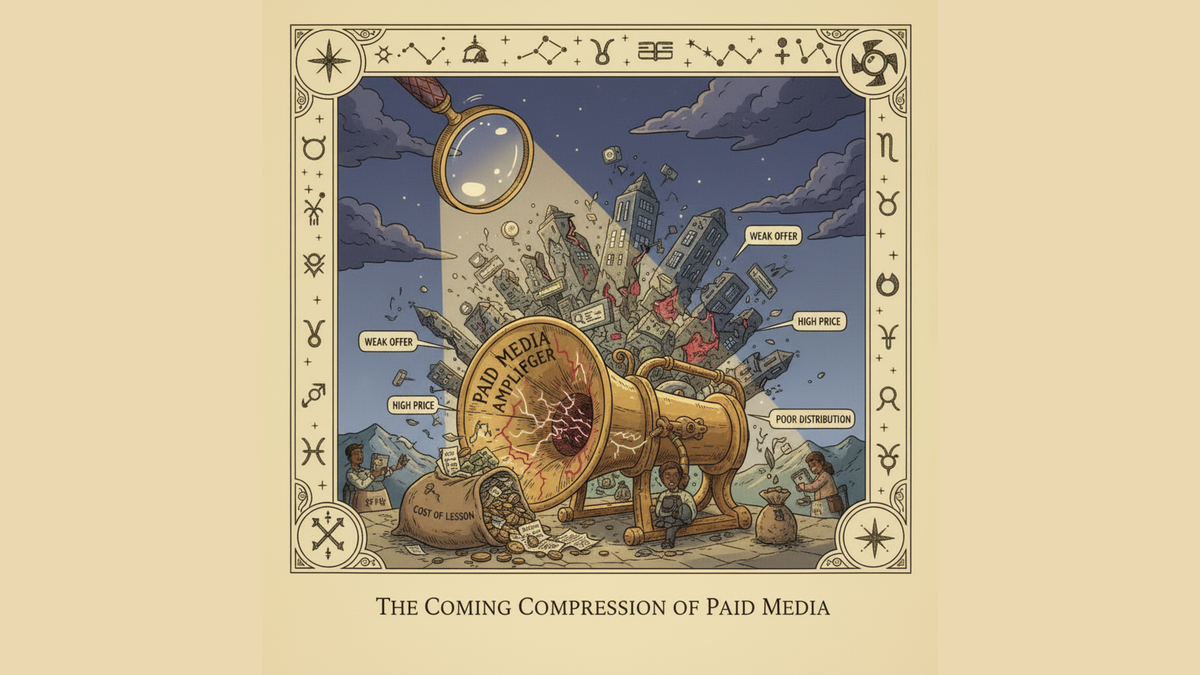

The Coming Compression of Paid Media

The hardest truth for leadership is that paid media is no longer a growth engine by default. It’s an amplifier. If the underlying offer, pricing, or distribution is weak, paid media will surface that weakness faster than ever—and charge you for the lesson.

Paid media is getting tighter. Not louder. Not flashier. Tighter.

This isn’t a cycle. It’s compression.

For years, growth was propped up by expansion: new platforms, cheap inventory, loose targeting, forgiving attribution. You could be sloppy and still win. The system absorbed mistakes because there was room to run.

That room is gone.

Inventory is finite. Attention is rationed. Platforms are optimizing for their own survival, not your efficiency. Every layer between impression and outcome now takes a cut—data, tooling, middleware, creative production, compliance. The margin used to live in the gaps. Those gaps are closing.

Compression shows up first in places teams misread.

CPMs rise, but not dramatically.

ROAS holds, but only at lower spend.

Incremental lift becomes harder to prove, even when dashboards stay green.

This is where bad decisions get made.

Teams chase scale inside channels that are already saturated. They push budgets past the point of efficiency because stopping feels like failure. They mistake “still working” for “worth expanding.”

The real signal is this: performance curves flatten faster than they used to.

You can still turn spend into results, but the slope is steeper. Each additional dollar buys less certainty. Each optimization delivers diminishing returns sooner. That’s compression doing its work.

AI accelerates this, not because it’s magic, but because it removes inefficiency at the platform level. When everyone has access to similar optimization, differentiation collapses. Advantage shifts away from execution and toward judgment.

Judgment about timing.

Judgment about saturation.

Judgment about when not to spend.

The winners in compressed markets aren’t the most aggressive buyers. They’re the best allocators. They move budgets earlier, pull back sooner, and accept that some demand can’t be forced without eroding margin elsewhere.

This also changes creative’s role.

In expansionary periods, creative scaled reach. In compression, creative has to earn attention. Generic assets decay faster. Safe messaging blends into the background. What survives is specificity—clear value, clear audience, clear moment.

Compression punishes vague thinking.

The hardest truth for leadership is that paid media is no longer a growth engine by default. It’s an amplifier. If the underlying offer, pricing, or distribution is weak, paid media will surface that weakness faster than ever—and charge you for the lesson.

This doesn’t mean retreat. It means precision.

Spend where signal still travels cleanly.

Stop before efficiency collapses.

Build systems that expect diminishing returns and plan around them.

Compression doesn’t kill paid media.

It exposes who was relying on slack.

In the next phase, success won’t belong to teams who spend the most, test the fastest, or automate the hardest.

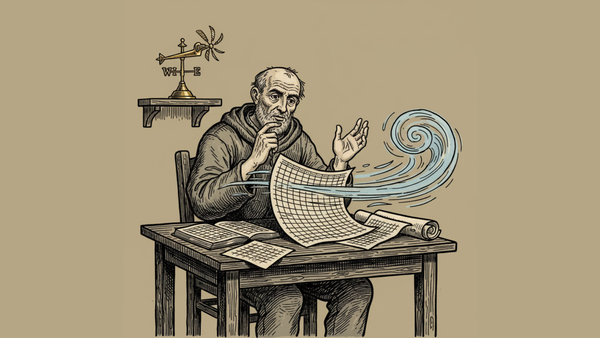

It will belong to the ones who know when the field is crowded, when the soil is thin, and when the smartest move is to conserve seed until conditions change.

That’s not pessimism.

That’s farming.