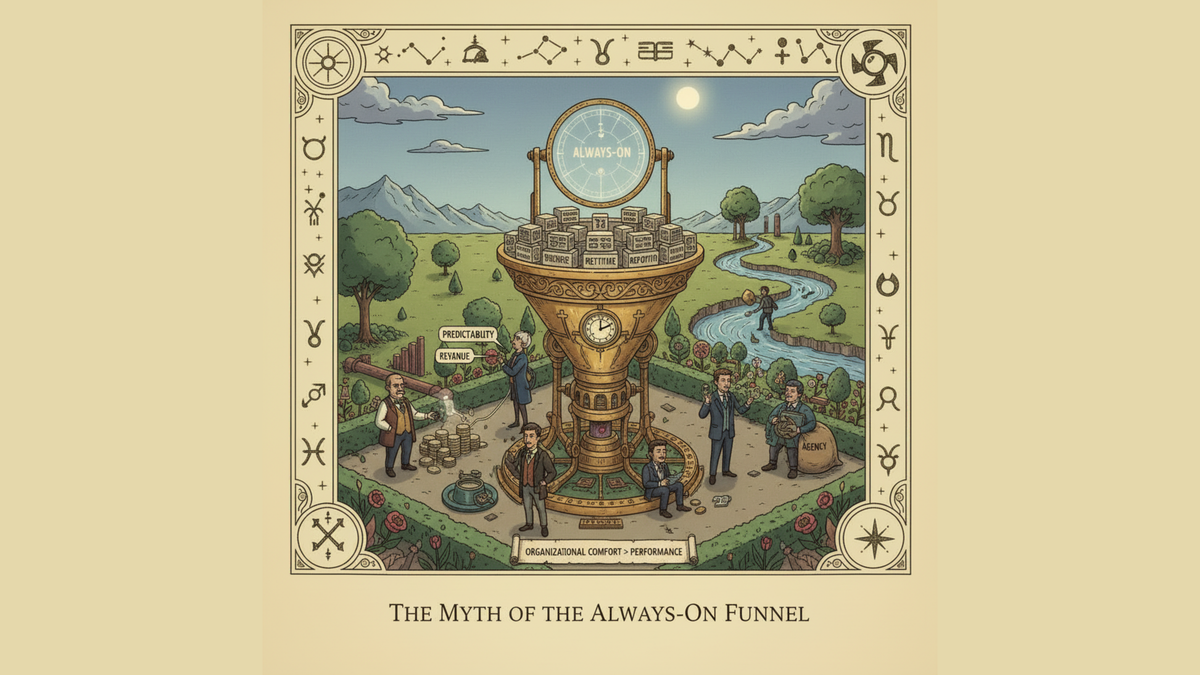

The Myth of the Always-On Funnel

Operators who insist on always-on funnels are often solving for organizational comfort, not performance. Finance likes predictability. Leadership likes dashboards that never go dark. Agencies like retainers that don’t fluctuate.

“Always on” sounds responsible. Mature. Grown-up.

It suggests discipline, consistency, a steady hand on the wheel.

It is also one of the most misapplied ideas in modern marketing.

Funnels were never meant to be permanent infrastructure. They were meant to be machinery you spin up when conditions justify the burn. Somewhere along the way, that nuance got flattened into doctrine, and now teams keep engines running long after the road disappears.

The logic usually goes like this:

If demand exists, you should be capturing it.

If you turn things off, you’ll miss something.

If you pause, you’ll lose momentum.

What gets ignored is the cost of pretending momentum is infinite.

Always-on funnels assume stable inputs: predictable demand, consistent inventory, reliable audiences, and platforms behaving themselves. Those conditions almost never hold for long. When they drift—and they always drift—an always-on system doesn’t adapt. It leaks.

The leakage is subtle at first. CPMs creep. Lead quality softens. Conversion rates wobble but don’t collapse. Dashboards still look “fine,” which is how waste hides in plain sight.

This is where teams confuse continuity with effectiveness.

A funnel that runs year-round doesn’t learn faster. It just produces more data about a system that may no longer exist. Optimization starts happening inside a shrinking box. You get better at extracting value from weaker signal instead of asking whether the signal is worth extracting at all.

Seasonality used to force discipline here. Campaigns had beginnings and endings. Budgets had arcs. You planted, waited, harvested, and rested. Each cycle reset assumptions and sharpened judgment.

Always-on erased the rest phase—and with it, perspective.

The irony is that the best funnels still behave as if they’re seasonal. They surge when demand is real, pull back when it thins, and accept silence as information instead of a threat. They are monitored continuously, yes—but activated selectively.

That selectivity is what creates leverage.

Turning a funnel off is not failure. It’s a declaration that the current conditions no longer justify the spend. It creates contrast. When you turn it back on, changes are visible. Signal clears. Decisions get easier.

Operators who insist on always-on funnels are often solving for organizational comfort, not performance. Finance likes predictability. Leadership likes dashboards that never go dark. Agencies like retainers that don’t fluctuate.

None of those are the same as effectiveness.

The harder posture is admitting that some weeks the right move is to do nothing. To let demand reveal itself instead of manufacturing the appearance of it. To preserve capital and attention until the market earns your activation.

Funnels are tools.

Markets are seasons.

Confusing the two is how efficiency quietly turns into habit.

The myth of the always-on funnel persists because it feels safe.

The truth is messier—and far more profitable for those willing to work in cycles instead of pretending the year has no winter.